SDGs

RESCUE

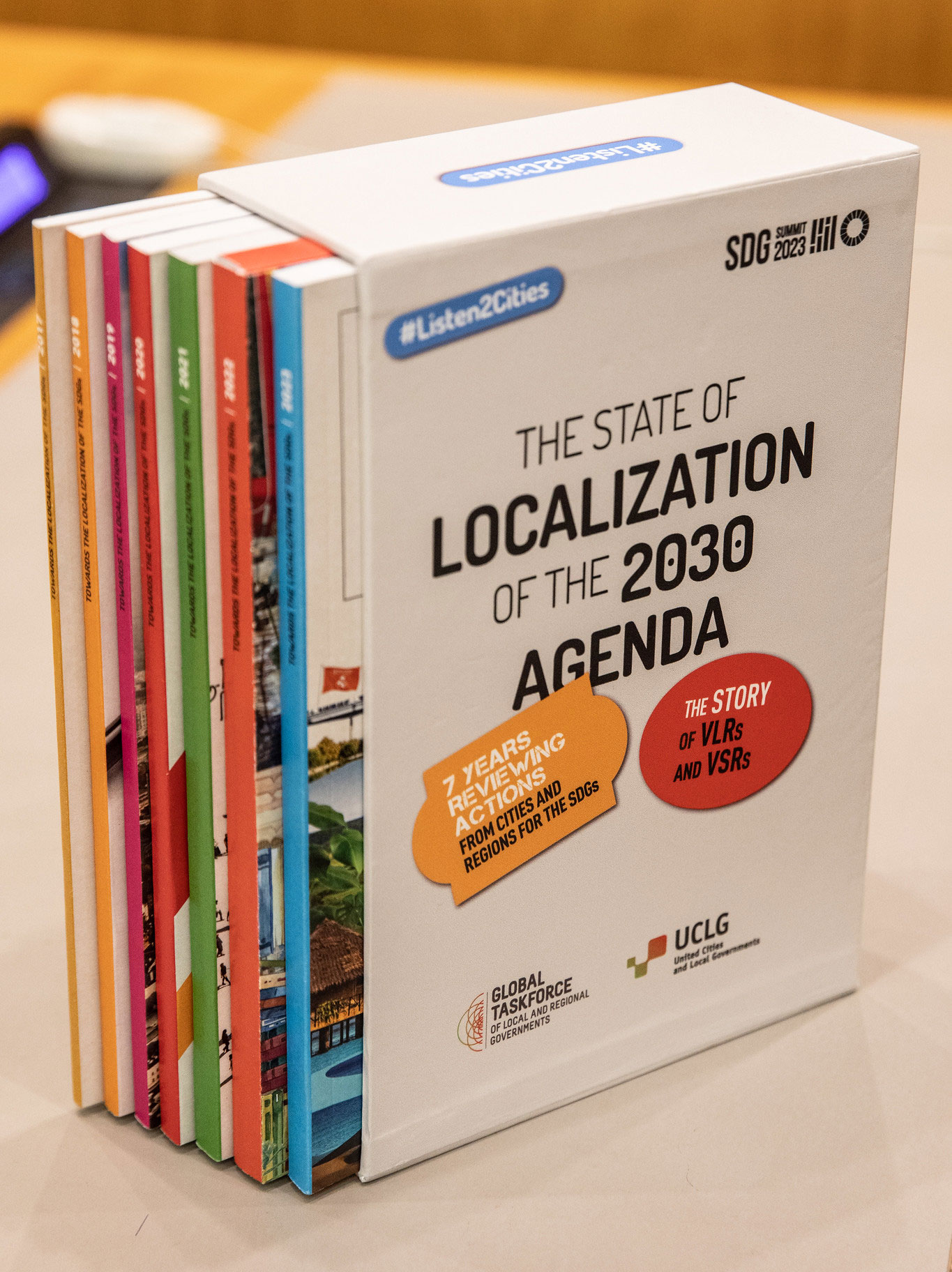

The SDG Summit 2023 opened with a clear and loud message from the United Nations Secretary-General, António Guterres, “only 15 per cent of the targets are on track, and many are going in reverse. Instead of leaving no one behind, we risk leaving the SDGs behind.” He proposed member states a global SDGs rescue plan, especially on improving developing countries’ access to finance.

At the Summit, UCLG presented a Decalogue of High-Impact Coalitions to scale up local action with global impact.

The Global Sustainable Development Report 2023, the latest update on progress on the SDGs, produced once every four years, was the first one to present how SDGs progressed after the impact of the pandemic. It reaffirmed the evidence that the world is “far off track” in achieving the SDGs. However, it still underscored the places of hope, such as considering that “the prospects have improved,” especially regarding knowledge and evidence related to the Goals. Furthermore, it called for “increased ambition and transformative interventions” to accelerate progress.

In this sense, the report outlines six elements in which local governments stand out as recipients of contextual and indigenous knowledge and laboratories of innovation for action on the SDGs. In this sense, the report fosters the development of national plans underpinned by local expertise and inclusive, bottom-up and participatory decision-making. It also encourages collaboration amongst local governments for better-shared learning, evaluation, and the recognition of successful steps. Overall, it pays attention to the crucial role of partnerships in enhancing the science-policy-society interface for rebuilding trust.

Earlier in the year, ahead of the G20 Finance Ministers and Central Bank Governors Meeting in February 2023, Guterres launched the SDGs Stimulus, identifying three areas for immediate action: tackle the high debt costs and increasing risks of debt distress, including by converting short-term, high-interest borrowing into long-term debt at lower interest rates; massively scale up affordable long-term financing for development, primarily through public development banks, including multilateral development banks, and by aligning all financing flows with the SDGs, and expand contingency financing to countries in need. He also called for mobilising at least $500 billion in new investments to be made available to developing countries annually, warning about the “great finance divide,” which leaves the Global South more susceptible to shocks.

During the 2023 session of the Economic and Social Council forum on financing for development follow-up, countries committed themselves to expanding social protection and improving access to concessional financing and debt relief for vulnerable countries. At the same time, UN DESA, UNDP, OECD, the European Union, Italy and Sweden launched the Integrated National Financing Framework Facility to support countries in formulating new national financing strategies for achieving the SDGs.

The Global Investors for Sustainable Development Alliance, a group of leaders of major financial institutions and corporations worldwide, extended its mandate until 2025. The Alliance aims to deliver solutions to scale up long-term private financing for sustainable infrastructure and offers policy recommendations for mobilising more funds for sustainable development. At the end of November 2023, the Alliance announced a call to action to heads of state, policymakers and multilateral development banks officials to scale private capital mobilisation and “unlock an unprecedented and urgently required flow of private capital to assist accelerating the development and decarbonisation” of Emerging Markets and Developing Countries (EMDCs) and the whole world.

In addition, the Sustainable Development Goals Investment Fair connected private financiers with investment-ready projects in emerging markets. Since 2018, the Investment Fair has showcased over $11 billion worth of projects from 22 countries.

Another mechanism to boost accelerated global action is the Joint Sustainable Development Goals Fund, which channelled over $260 million to 31 United Nations organisations to help 119 Member States respond to the cost-of-living crisis, extend social benefits for over 175 million people and leverage over $2.3 billion in additional financing. The Fund also opened a new “development emergency” window to help address the food, energy and finance crises.

The Local2030 Coalition UN Directors Group has also adopted an SDG Localization Marker at the beginning of February 2024. This initiative recognises SDG localisation as a fundamental and pivotal driving force to achieve all SDGs. It commits the Fund to fostering targeted initiatives that propel the advancement of SDG localisation. It aims to support UN Country Teams in applying the Localization Marker to the design, implementation, and accountability of joint programmes supported by the Joint SDG Fund.

Aligned with these initiatives and the urgent call to mobilise resources, the U20 Climate Finance Working Group issued a statement calling “national leaders, development finance institutions and private sector to work with cities to accelerate availability and access to urban climate finance.” The statement also recognised the efforts of the SDSN Global Commission for Urban SDG Finance, created in June 2023 by the Penn Institute for Urban Research (Penn IUR) in partnership with the UN Sustainable Solutions Network (SDSN). The Commission comprises six task forces working on analysing barriers to urban SDG finance, and a final report is expected to be published in the spring of 2024.

In 2014, UNCTAD estimated that between $3.3 and $4.5 trillion per year would be required to achieve the ambitious goals outlined in the 2030 Agenda. Fast forward to 2024, and projections indicate an even greater investment need: an additional $150 trillion by 2050 for advancing energy transition technologies and infrastructure.

To put this into perspective, an annual investment of $5.3 trillion is deemed necessary solely for transforming the global energy sector. However, despite these pressing demands, the promise made by developed nations to provide $100 billion in climate finance annually by 2020 has fallen short, with funding reaching only $89.6 billion in 2021.

As we face the challenges of climate change, establishing the Loss and Damage Fund, agreed upon during COP28 with an initial commitment of $792 million, becomes increasingly critical as we progress into 2024.

The Third South Summit, which convened in Kampala in January 2024 with representation from the 135 members of the Group of 77 and China, acknowledged the efforts made during COP28. Yet, it underscored the necessity for substantial reforms in international financial architecture. As emphasised by the summit, these reforms should better align with the needs and priorities of developing nations while also addressing the persistent debt crisis. Additionally, the summit called for creating the requisite fiscal space to enable economic recovery and facilitate the attainment of the Sustainable Development Goals (SDGs).

Urgent action is also demanded to scale up debt swaps, particularly those focused on climate and environmental preservation. Moreover, developed countries and international financial institutions were urged to take decisive steps in implementing the SDG Stimulus to support these objectives further.

Looking ahead, the Fourth International Conference on Financing for Development scheduled for 2025 holds immense significance. This conference is a pivotal milestone a decade after the Addis Ababa Action Agenda and its framework for financing sustainable development. It represents perhaps the final opportunity to catalyse genuine and accelerated action towards fulfilling the ambitious objectives outlined in the 2030 Agenda.

Cities People

Multilateral

System Peace

Governments

2030 Agenda

Care Planet

Solidarity

Rights Social

Equality New

Territories

Sustainability

Municipal

Movement

This publication was produced with the financial support of the European Union. Its contents are the sole responsibility of UCLG and do not necessarily reflect the views of the European Union.

This publication was produced with the financial support of the European Union. Its contents are the sole responsibility of UCLG and do not necessarily reflect the views of the European Union.